Kenyan women build businesses and power thanks to village savings groups

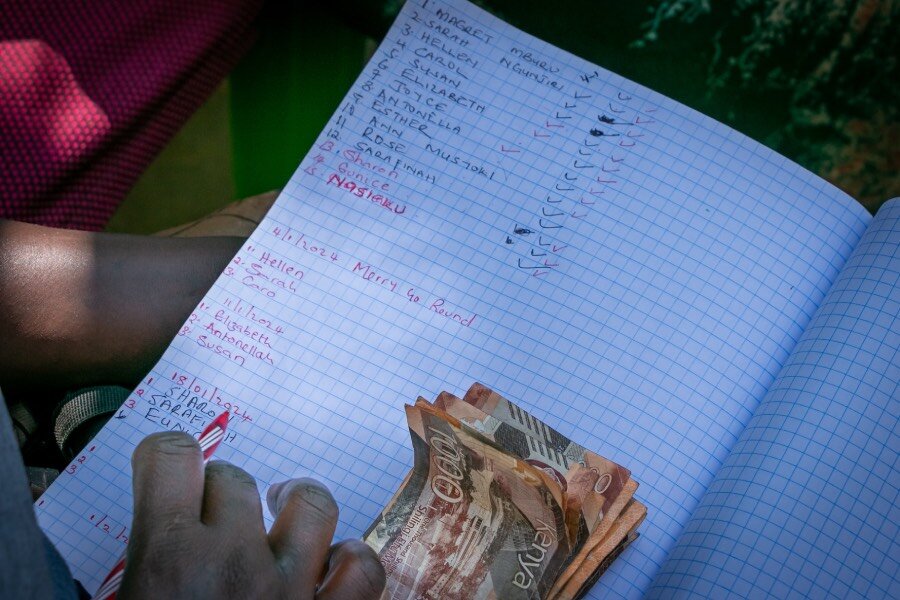

A group of Kenyan women sits in a circle one recent afternoon, a metal box in the middle. It looks like a toolbox except for three telltale locks. Pocket-sized record books lie strewn on the floor. Money changes hands – many times. For an outsider, the process taking place is difficult to follow, but these entrepreneurs know each step by heart.

The recent gathering in the town of Maralal is replicated across the 60 women-dominated village savings-and-loans associations here in Samburu County, roughly a six-hour drive north of Nairobi. Comprising between 15 and 25 members each, and supported by the World Food Programme (WFP), the groups offer the women a first, crucial step up the economic ladder in this deeply conservative region.

Educating women

“I have educated my daughters, who would have otherwise not have gone to school,” says 36-year-old Stella Akai, a mother of seven – and the unofficial ‘mother’ of the Samburu savings groups – ticking off some of the many paybacks.

Like elsewhere in northern Kenya, educating girls is not a priority here. And while women can own property, they cannot profit from it – unless they do so behind their husbands’ backs.

Akai hopes to change this. Trained and supported by WFP, she has since created and in turn trained 35 savings groups in Samburu County since 2021 – retaining membership to each one, and passing on her skills to hundreds of other women.

“The weekly contributions keep me active,” says Akai. “I closely monitor each group’s progress and my presence gives the women the confidence to walk the journey.”

Today, many other Kenyan women are taking that same journey. So far, WFP has supported nearly 3,000 similar savings groups in 11 counties, training trainers like Akai, and connecting women to local government offices that can offer further backing. With women making up roughly 85 percent of membership countrywide, the groups offer them a powerful vehicle for change.

Reshaping the narrative

“Village savings groups are reshaping the narrative about rural women's economic empowerment. By providing access to finance in the form of savings and credit, these groups are bridging the financial gap for rural women and promoting equal decision making in the family,” says Phyllis Kariuki, a cimate risk and financial inclusion specialist at WFP.

Under the scheme, Samburu group members buy between one and five shares per meeting, each worth the equivalent of US$0.07. The money goes into a communal pot for loans that must be repaid with 10 percent interest. At the end of the year, after recovering all the loans, members then share out the final pot of money – and the cycle starts all over again.

“The methodology is simple – even for the uneducated,” Akai says. “This is what makes the concept stick, once people see the results.”

Last year alone, Samburu members realized roughly 31 million Kenyan shillings (around US$220,000) in savings and profits. That amounts to a sizable sum in a region where those lucky enough to find work earn as little as US$3 a day.

The earnings helped members to launch small businesses and invest in other priorities, such as buying land and sending their kids to school.

“WFP is now helping train the groups in new ways of making a living, such as beekeeping, while exploring markets for their produce,” says Charles Songok, head of WFP’s Samburu office. “The women are saying that they now have the capital, all they need are profitable value chains to invest in.”

Looking out for their girls

Akai has seen those results firsthand. Married as a second wife in 2016, she opted to live separately, to ensure her teenage daughters could get the same schooling she had growing up.

Because of her previous experience with savings-and-loan schemes, WFP trained and paid Akai to form new associations. She is particularly proud of one local group, comprised of former sex workers and alcohol addicts, who have morphed into savvy young businesswomen.

Her WFP earnings allowed Akai to buy livestock, which she fattens and sells at a profit – and to grow vegetables for home consumption and sale. Bit by bit, she quietly invested in small parcels of land – ensuring her daughters were included in the ownership titles.

“I know that if anything were to happen to me today, all this property would revert to my husband,” Akai says, explaining her secrecy, “and there is no telling where my daughters would end up.”

Rose Lekairab, too, is looking out for her girls. The 42-year-old farmer and vegetable vendor counts among the roughly 1,000 local women who have joined the Samburu savings movement. Like Akai, she used the loan scheme to set up a vegetable business, then began trading livestock – the region’s top industry.

When Lekairab’s eldest daughter graduated high school, she applied for a loan and opened a food kiosk for the young woman, which later became a small restaurant.

“I didn’t have money to pay college fees,” Lekairab says, “so we started a small business for her.” Now 23, Leikairab’s daughter runs the biggest restaurant in town.

“This is a watershed moment for rural women,” says Phyllis. “This ‘movement’ is dismantling age-old beliefs and propelling women to break barriers – one savings group at a time.”

WFP’s integrated climate adaptive support activities have been made possible through the generous support of Germany, The Netherlands, Norway, private donors and the United Kingdom.